Escalating construction costs: What brought us here, what can project managers do now, and could there be hope ahead?

Let’s set the scene.

It’s Dallas, Texas, and the build-out of a 38,000 square foot office space, moving a headquarters from Waco to Dallas, is experiencing delivery delays and extended lead time for fabrication of movable walls. Quoted lead times have increased by a month impacting overall project timetables.

It’s Toronto, Canada, and office space projects across the board are experiencing budgetary increases and long lead times. Inflation line items are being added to project budgets compromises and substitutions for wood and metal wall finishes are being made, and contractors are advancing shop drawings for appliances and lighting well ahead of typical schedules, to accommodate gaps and lags in the supply chain

It’s London, England and a key artisan sub-contractor who has largely employed a more elderly labor force faces decreased resourcing, output and installation rates as individuals stop working to take care of themselves and protect their vulnerability amidst a global pandemic. These labor shortages decrease availability of workers to complete critical work, increasing timetables and the cost to complete.

In short: if your work touches construction right now, you are feeling pain from every angle.

Rampant delays, cost increases and labor shortages are creating construction issues across industry and global lines like we’ve never seen before, and if you work in materials sourcing, construction or project management, these stories, all real examples collected from Avison Young project managers, probably feel like they could be your own.

If your project requires materials, you are experiencing the harsh delays and increase in cost felt by the masses, and probably have a lot of questions too, such as:

how did we get here, and how do we help ourselves and our clients through these challenging market conditions?

Let’s start with:

How we got here

It might be even more complicated than you think.

Shortages in supply and increases in demand are driving up costs

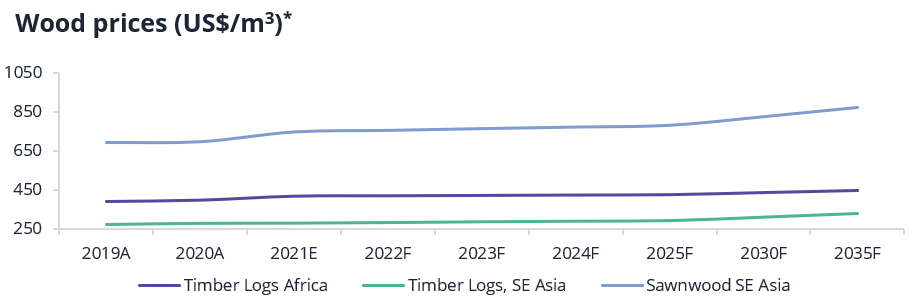

Rising shortages in key construction materials, such as lumber, steel, and copper, driven by the global pandemic, “just in time” production practices, and other crisis dating back decades, are expected to continue to put upward pressure on the raw materials prices for years to come.

Source: EIU, Broker notes, Factiva

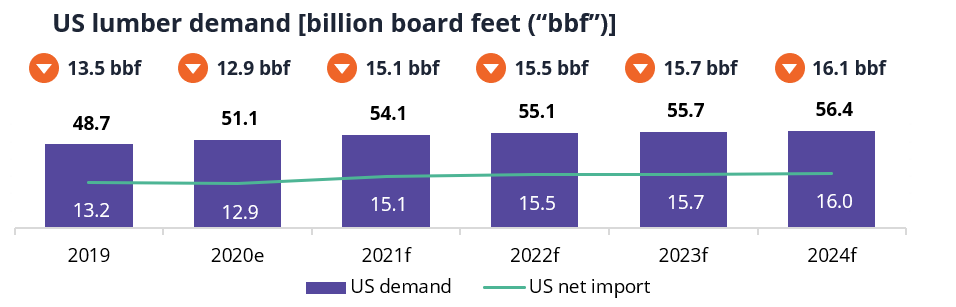

The U.S. has historically faced severe shortages in lumber, which has led to increasing imports from Canada, Europe and China. Current shortages, driven by increase in demand for commercial and residential construction projects, paired with external factors such as recent North American wild-fires, Canada’s 1990s pine beetle crisis, and shutdown of lumber mills, is expected to continue through forecast years.

Source: EIU, Broker notes, Factiva

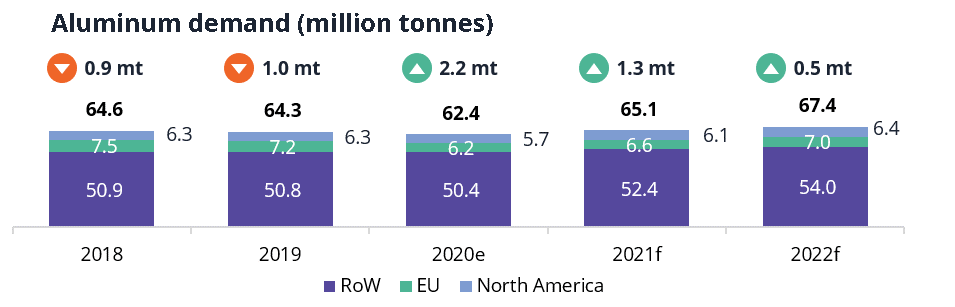

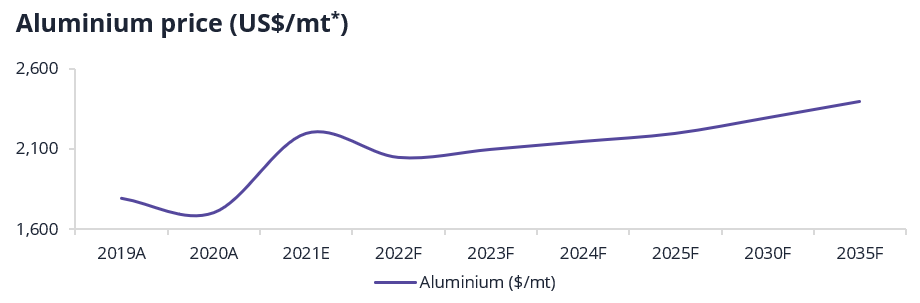

The global aluminum demand decreased 2.9% in 2020 given COVID-19 driven lockdowns, leading to a surplus of 2.2 million tonnes. Aluminum demand growth is expected to outstrip supply growth until 2022 and reduce the surplus to 0.5 million tonnes in 2022.

Source: EIU, Broker notes, Factiva

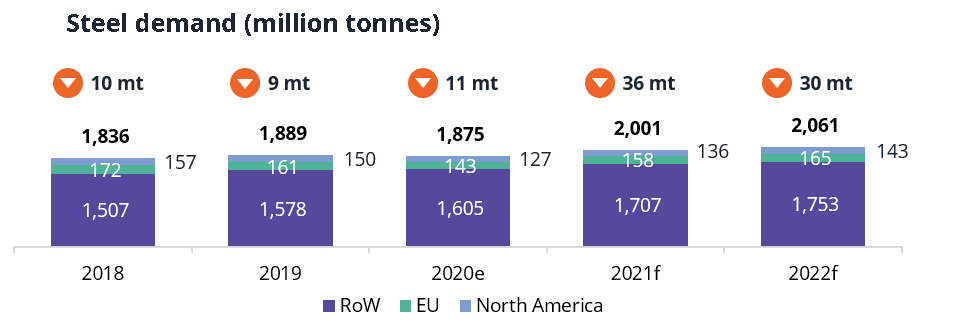

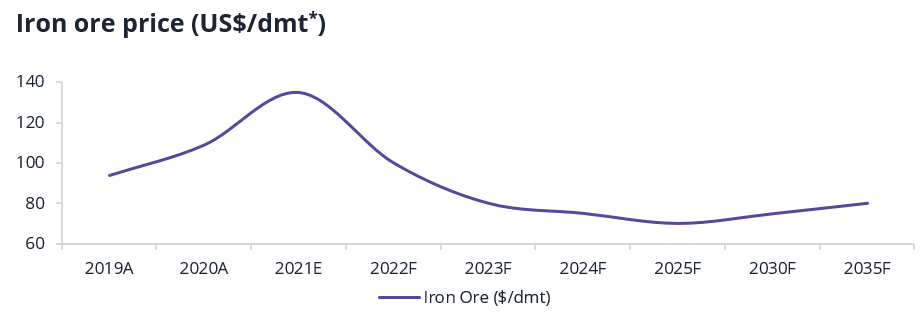

Shortage of steel increased to 11 million tonnes in 2020 and the shortage is expected to amplify over the next few years, reaching a high of 36 million tonnes in 2021.

Source: EIU, Broker notes, Factiva

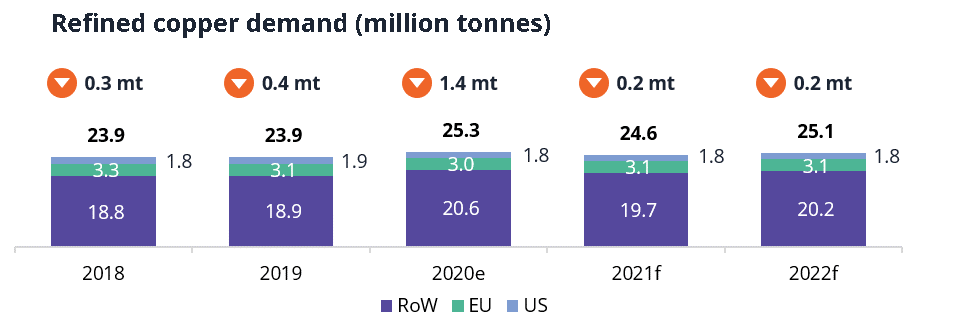

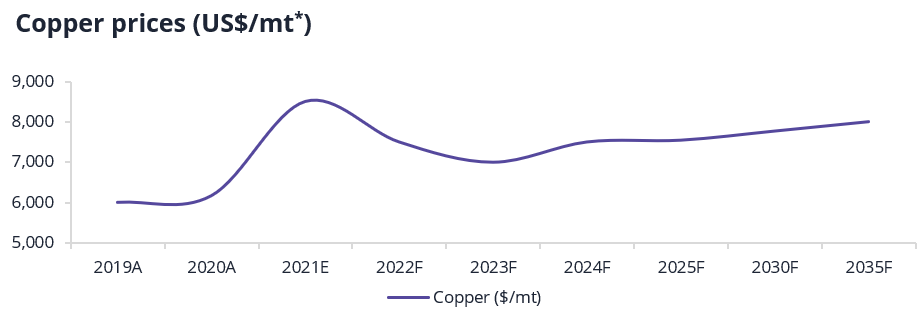

After a significant increase in the shortage in copper in 2020, driven by continued stockpiling of copper in China, shortage is expected to decrease to reach 0.2 million tonnes in 2022.

Pair these shortages with:

- increases in demand tied to rising desire for residential and commercial projects during the pandemic

- overall availability to import/export with opening and closing of country borders

- shifting and evolving trade relations

- the current resurgent global economy

You have the perfect recipe for rising costs and impact for years to come.

Notes: * m3: cubic meter, mt: metric tonne, dmt: dry metric tonne

Source: Bloomberg, Broker notes

As a result of COVID-19 and increasing shipping costs, imports have been negatively impacted, which has put increased stress on demand for local timber, which is causing a rise in prices. Moreover, the global construction boom following COVID-19 is impacting prices upward.

Notes: * m3: cubic meter, mt: metric tonne, dmt: dry metric tonne

Source: Bloomberg, Broker notes

Green stimulus policies globally support the use of aluminum in construction and electric vehicle assembly, which will lead to rise in demand for metal.

Notes: * m3: cubic meter, mt: metric tonne, dmt: dry metric tonne

Source: Bloomberg, Broker notes

Copper prices are expected to continue an upward trend, driven by intensifying challenges in supply chain like higher taxation on miners to reduce fiscal deficit in copper producing countries.

Notes: * m3: cubic meter, mt: metric tonne, dmt: dry metric tonne

Source: Bloomberg, Broker notes

The resurgence of the global economy following the COVID-19 pandemic has led to a rise in prices of iron ore across industries. The rise in prices has not deterred mill owners from producing irdon ore so as to take advantage of this resurgence which has demand rising upwards.

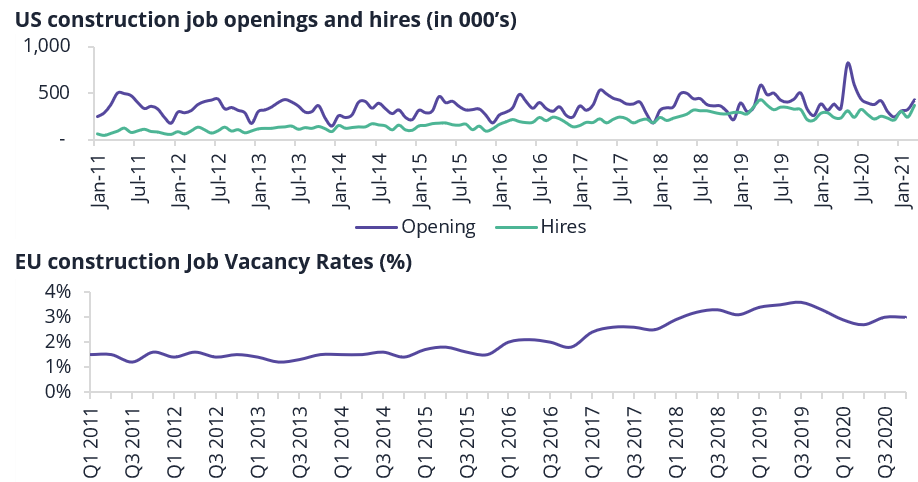

But it’s not just supply, there are skilled labour shortages happening too

The global construction market is highly dependent on people but has been marred by a shortage of skilled labour since the 2008-2009 economic downturn. This has led to project delays and signficiant increases in overall construction costs that have only worsened in current markets.

Skilled craftsman who left the market during the recession don’t plan to return and the pandemic caused early retirement from some in older generations who couldn’t work given the conditions. Younger generations are simply lacking the interest in pursuing these critical trades, causing a serious gap in needed labour to meet current demands, adding to delays in construction projects.

Source: U.S. Bureau Of Labor Statistics, CPWR, Press articles, EIU

Torn with what to do, suppliers are stuck somewhere between stockpiling and just in time planning

Suppliers and countries see market conditions and some with means are choosing to purchase more than currently needed in anticipation of rising costs, impacting global availability and crushing prospects of those with lesser access to resource.

Those that were operating under “just in time” processes are finding that “just in time” is no longer on time – not even close – causing a need to scramble for more supply to meet critical demands in ever-shifting conditions.

And then, there are the majority – caught somewhere in the middle forced to figure out how to find the supply they need, considering any and all possible concessions and materials swaps to get the job done.

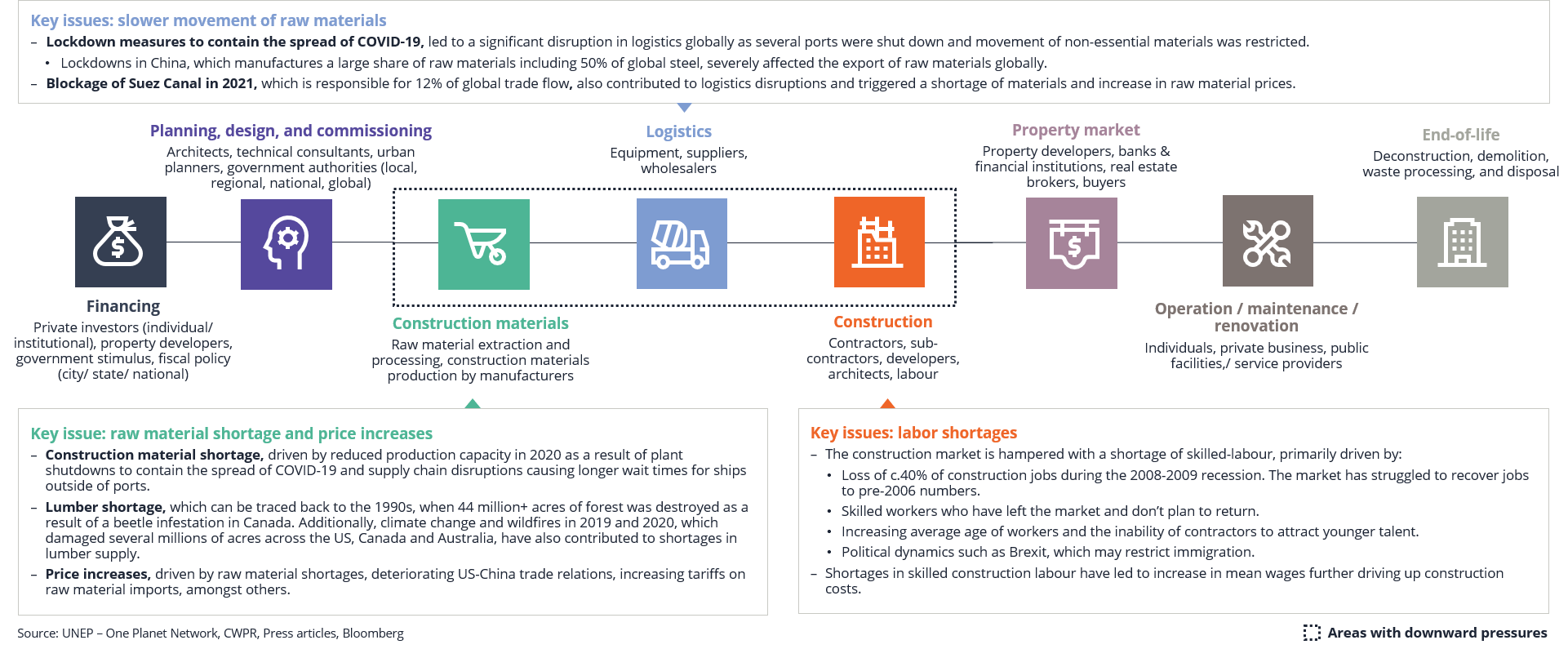

Enter: supply chain disruptions at every level

The key challenges plaguing the construction supply chain are materials shortages and high prices at the time of procurement, along with snags in key transportation and the warehousing phases.

All the while, market demand only continues to rise

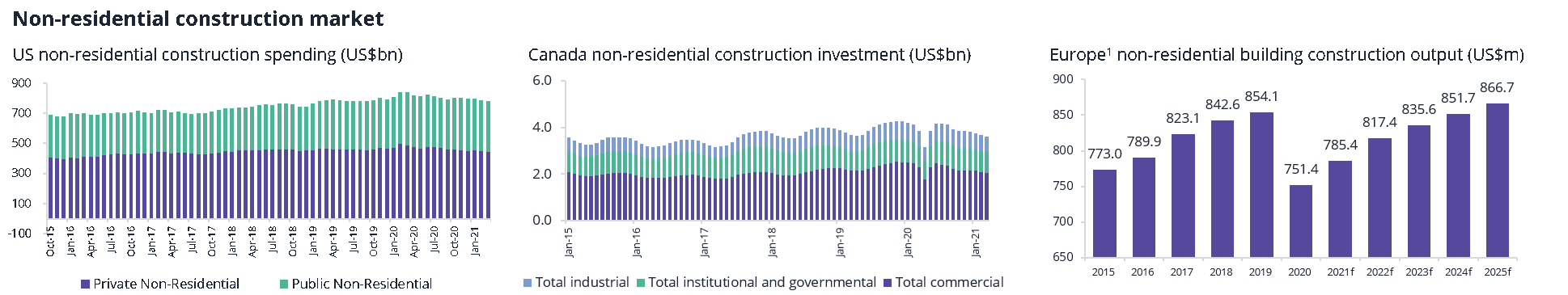

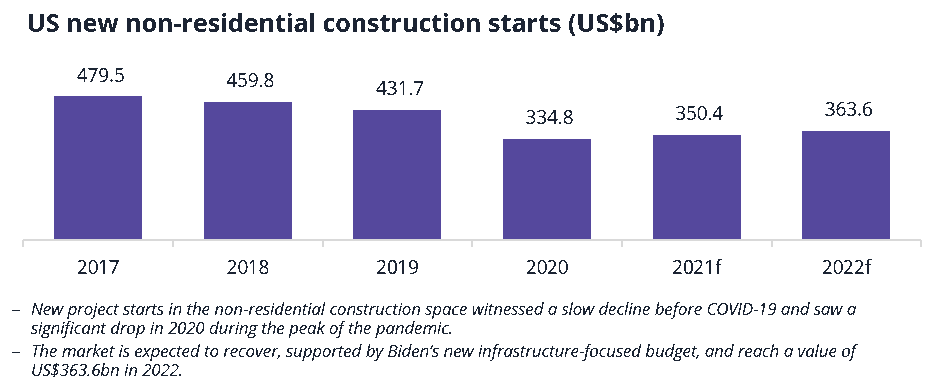

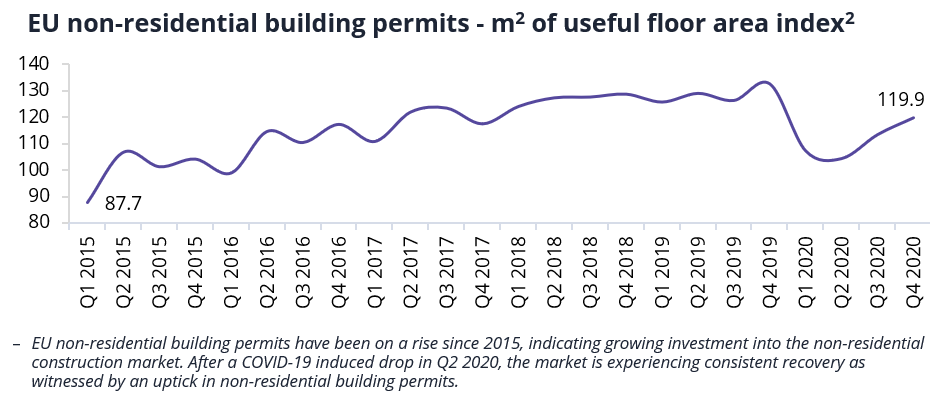

Following a slowdown induced by the pandemic in 2020, the non-residential construction market has begun a gradual recovery on the back of infrastructure and office renovation projects.

Notes: 1) Includes 32 countries in Western and Eastern Europe

Source: Eurostat, US Census Bureau, Oxford Economics, U.S. Chamber of Commerce, Statcan

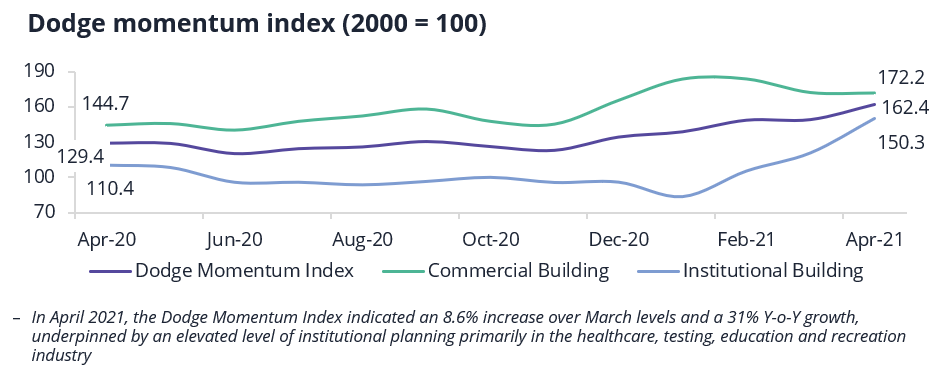

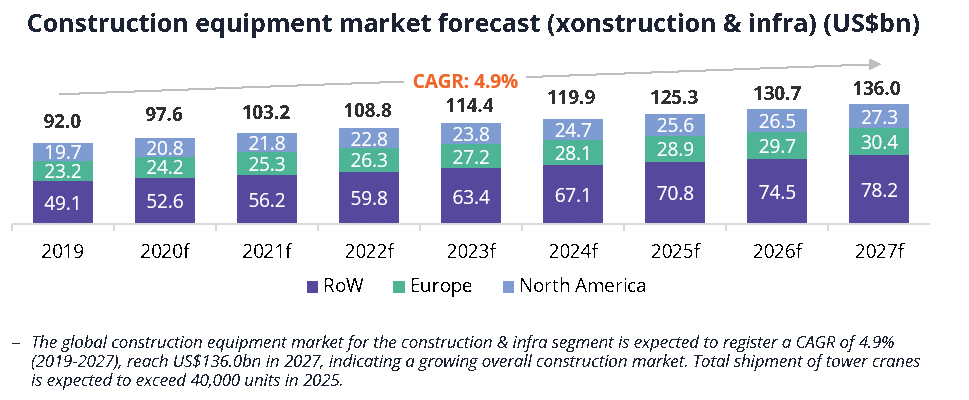

Longer-term outlook for non-residential remains positive, supported by improving contract confidence and positive sentiment around revenue expectations for the next 24 months across key markets.

According to the U.S. Chamber of Commerce, 86% of U.S. contractors report moderate to high confidence in new business and 29% report high degrees of confidence in winning new projects.

In Canada, total investment increase year over year by March 2021, driven by several high value projects in Montreal and construction in Vancouver, as well as big gains in Ontario and Alberta.

European markets are similarly expecting construction output to recover to 2019 levels by 2024.

All these global activity projections are supported by recovering non-residential construction in the US, rising non-residential building permits in the EU, and a growing global construction equipment market.

Notes: 1) EU15 countries include Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain, Sweden and the UK; (2) Index, 2015 = 100

Source: Eurostat, Allied Market Research, Dodge Data and Analytics

Notes: 1) EU15 countries include Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain, Sweden and the UK; (2) Index, 2015 = 100

Source: Eurostat, Allied Market Research, Dodge Data and Analytics

Notes: 1) EU15 countries include Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain, Sweden and the UK; (2) Index, 2015 = 100

Source: Eurostat, Allied Market Research, Dodge Data and Analytics

Notes: 1) EU15 countries include Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain, Sweden and the UK; (2) Index, 2015 = 100

Source: Eurostat, Allied Market Research, Dodge Data and Analytics

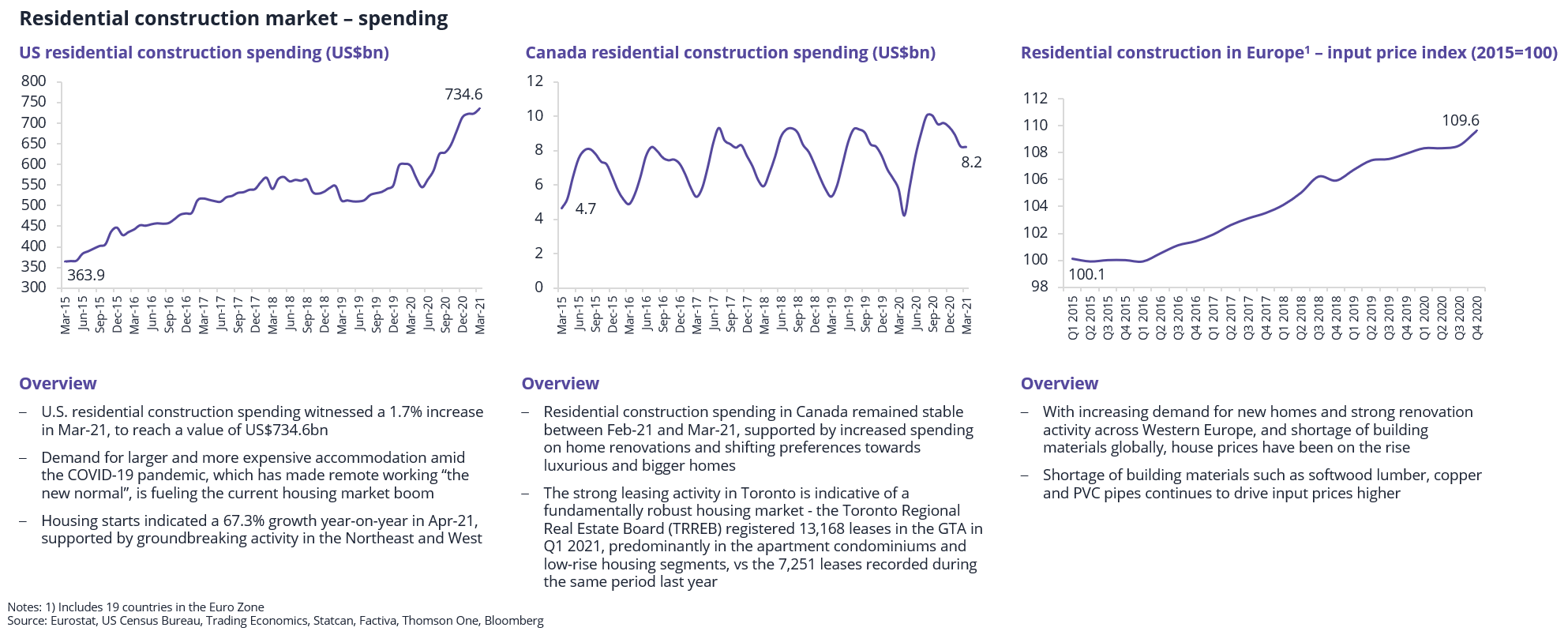

Home renovations and growing demand for bigger homes also continues an uptick in construction spending that indicates a fundamentally strong residential construction market that will continue to impact materials supply and demand.

Additionally, gradual recoveries in infrastructure, office renovation projects to meet new office needs in workplace strategy, and fluctuations in interest rates will also keep projects in flux as all try to find critical supply to address key demands.

What does this all mean for today’s projects? How can we manage right now?

There is no perfect roadmap for recovery, as conditions continue to evolve, but there are a few things project managers can consider, giving themselves better advantages against everything that is happening with supply and demand right now:

- Consider early buy strategies – how proactive can you be with sourcing?

- Consider a large, diverse supplier strategy – could a wider pool of supplier options help you find all you need faster?

- Adjust contracts/accounts for fluctuations – can line items be added to ensure expectations are set for these times?

- Build more flexibility into project timetables for both time-to-deliver and overall cost – can you create roadmaps that factor in the times, built on wider scales?

- Watch for positive market signs

Keep an eye on markets, gaps might close sooner than expected

Yahoo! Finance and others are starting to report drops in the cost of lumber, with Business Insider reporting a more than 50% drop in lumber price from the records reached in early May 2021, and prices continue to drop -- a great reminder that these large-gap markets won’t last forever and the name of the game remains uncertainty.

How and when we will see a trickle down in each market and for various products is still very much in question, and likely will be for some time, but we can assure changes for the better will come. Perhaps sooner than we all expect.

Get in touch

Canada

Sheila Botting, Principal & President Americas, Professional Services

Jason Kao, Project Manager, Project Management Services

U.K.

John Barnett, Principal and Managing Director, Project Management

U.S.

Jim Louis, Principal, Project Management

Jennifer Stark, Vice President, Project Management