Industrial fundraising hot spots: Where is capital flowing?

Industrial fundraising continues expansion into Europe, Asia Pacific

The familiar investment thesis of the recent past has not changed: investor interest in the industrial asset class continues to be real, salient – and global. In this edition, we quantify this thesis as we look at a number of examples of capital raises for industrial funds and their substantial buying activity, not just in the U.S., but around the world. It is our opinion that we will continue to experience sustained global investor interest in U.S. industrial product in the near term, yet, we are always curious as to what you think…do you agree? Disagree? As always, we value your engagement, insights, and certainly welcome your feedback to this newsletter.

Best,

Erik Foster

Principal

Head of Industrial Capital Markets

Industrial fundraising continues expansion into Europe, Asia Pacific

As capital continues to pour into the industrial sector, many investors have been active in expanding their footprints outside of the U.S., especially in Europe and Asia Pacific markets. Europe has become a hot spot for logistics, given its scarcity of warehouses and availability of land. As e-commerce continues to burgeon globally and manufacturing companies across the world increase production, there is an increasing demand for efficient and well-located logistics facilities.

A look at recent fundraising shows a strong appetite for strong performing assets with ties to logistics, e-commerce and related industrial uses.

EQT Exeter, for example, recently closed a EUR 2.1 billion logistics fund with an equity level that exceeded the fund’s EUR 1.25 billion target by nearly 70%. An EQT Exeter executive told PERE News that demand was so high that the firm was unable to accommodate some of the commitments without putting target returns at risk. The fund has a value-add strategy for acquiring, developing, redeveloping, leasing and operating supply chain and e-commerce related warehouse, last mile and light industrial properties in major European markets.

A few other notable examples in Europe include:

- NBIM, Norway’s central bank entity that runs its sovereign wealth fund, invested in 11 logistics properties in Berlin and the Rhine-Ruhr area with partner Prologis. The partnership also sold 27 logistics properties in several U.S. markets, including Memphis, Louisville, Seattle, Baltimore/DC and South Florida.

- Valor Real Estate invested EUR 30 million in urban logistics deals in Paris, acquiring four infill properties in prime submarkets. The properties are located in undersupplied submarkets that are desirable due to their proximity to growing and affluent population bases. One of the properties is vacant and slated for renovation, a sign that the supply/demand equation is pushing investors toward a wider pool of assets.

Investment volumes have also increased in Asia Pacific, according to Institutional Real Estate, Inc. A mid-year 2021 industry report noted overall commercial real estate volume with a 40% year-over-year growth rate, notably in China, Australia and South Korea. Logistics and other industrial assets accounted for a notable amount of that volume.

- This summer Singapore-based CapitaLand launched its second fund, the $300 million India Logistics Fund II, which will invest in six major cities. According to IPE News, through both this fund and its first Ascendas India Trust, CapitaLand plans on developing 20-25 million square feet by 2025.

- Macquarie Asset Management raised $1.1 billion AUS, according to the Australian Financial Review, for a ‘beds and sheds’ fund – a spectrum of rental housing and logistics property assets.

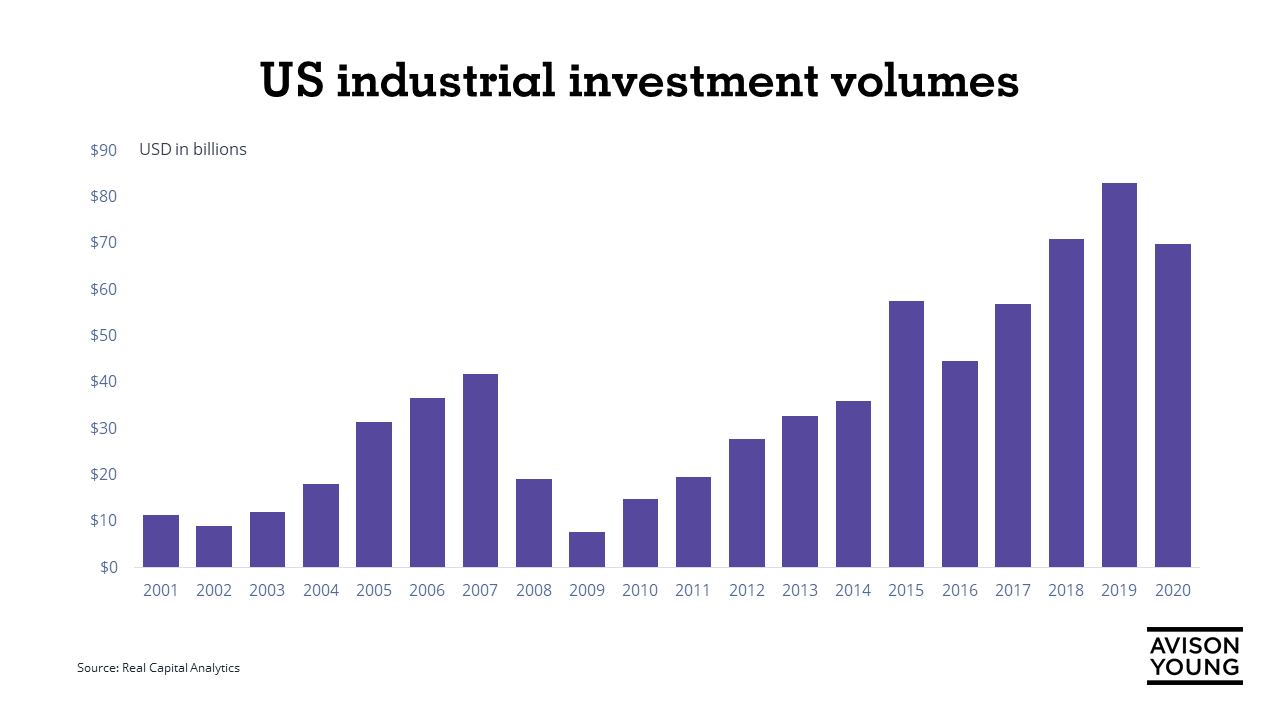

Overall, there remains significant capital in the market and much of it is being allocated for commercial real estate. According to Preqin, the total volume of U.S. real estate deals (in all sectors) in Q2 2021 was $68.3 billion, more than double the total from a year ago. Preqin also noted a 16% increase in real estate funds in the market in the first half of 2021 and a 15% increase in the amount of capital targeted. As industrial is a highly favored asset class -- and even more so given its performance during the pandemic -- it is among the top targets for this massive amount of capital.

One example is the New York State Common Retirement Fund (NYSCRF), which recently doubled its commitment to the Black Creek Industrial Fund, adding $200 million to the U.S. fund due to the fund’s strong performance. The fund is focused on U.S. core-plus assets and is targeting returns in the 9% to 10.5% range. It’s Q1 2021 net asset value as $1.22 billion.

While demand for industrial assets remains strong in the U.S., there is often a running scarcity of portfolios or prime assets on the market at any given time, making it more difficult for global capital sources to take large positions in the sector. This factor, along with the overall increase in demand for industrial space globally is pushing capital sources to expand into foreign markets, looking for additional opportunities to gain traction in this coveted sector. How much additional opportunity will this present for investors? Will this balance change over the next 12 to 18 months? Stay tuned as Avison Young continues to monitor the flow of capital and its impact on U.S. and foreign markets.

Sources: Bisnow, IPE News, IREI.Com, PERE News

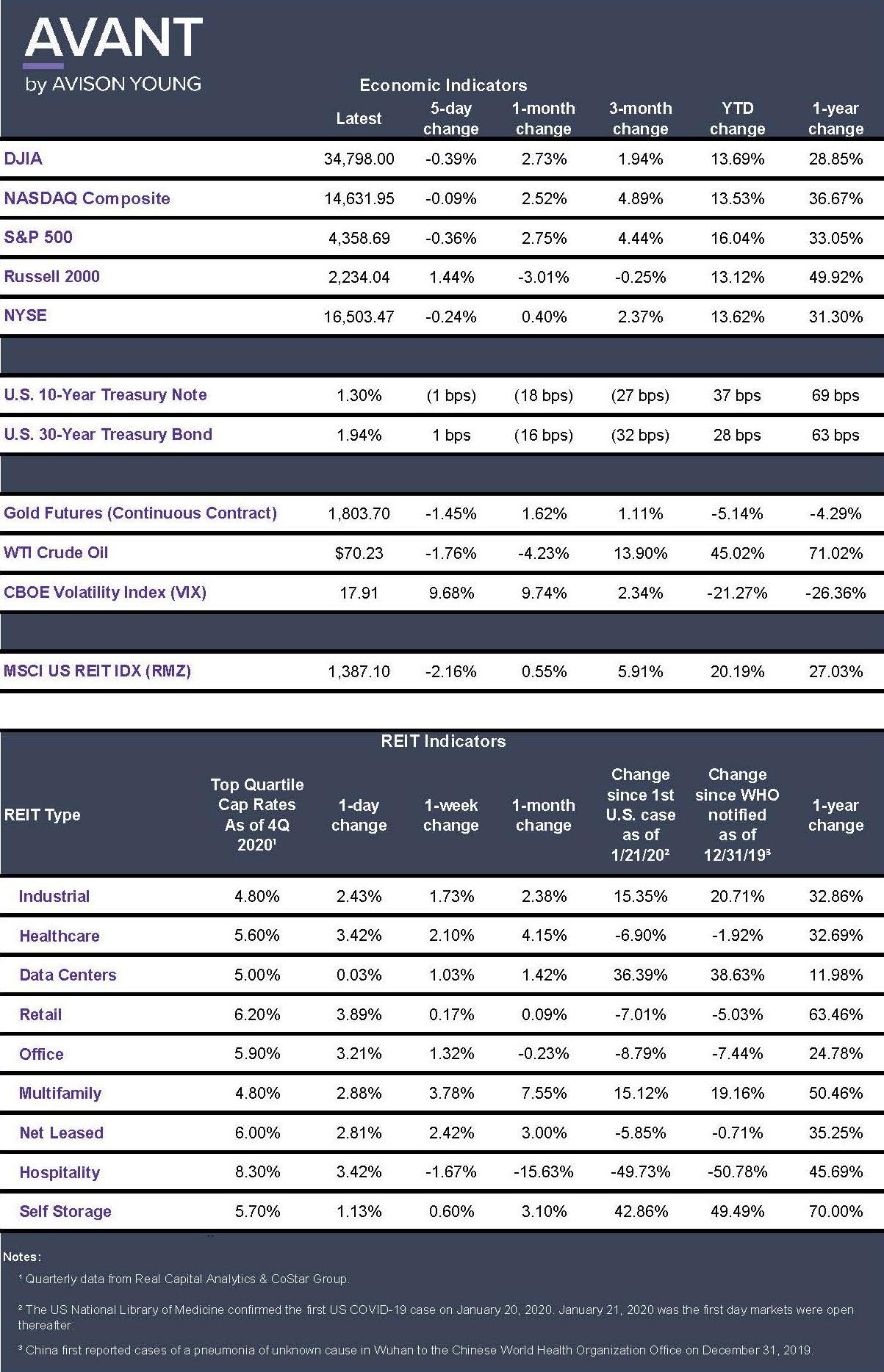

Click the image for Economic Indicators

Erik Foster, Principal

Head of Industrial Capital Markets

312.273.9486

[email protected]