Real Estate Market Report Q3 2023

Economic conditions

In recent months, forecasts for the German economic development have been revised downward multiple times. The year 2023 is now expected to end with a mild recession. The burden of high inflation and interest rates remains significant, overall demand from both domestic and international sources is weakening, and numerous uncertainties are hampering corporate decision-making processes.

To combat the still significantly high inflation, the European Central Bank raised interest rates for the tenth consecutive time in mid-September and maintained the level of 4.5% in October. With this expected end to the interest rate hiking cycle and stabilising financing costs, there is at least some return of planning and calculation certainty from this side. The inflation rate in Germany decreased from 6.1% in August to 4.5% in September, and according to initial estimates, it fell to 3.7% in October. Core inflation also significantly decreased. Various indicators suggest a further relaxation in price dynamics.

To combat the still significantly high inflation, the European Central Bank raised interest rates for the tenth consecutive time in mid-September and maintained the level of 4.5% in October. With this expected end to the interest rate hiking cycle and stabilising financing costs, there is at least some return of planning and calculation certainty from this side. The inflation rate in Germany decreased from 6.1% in August to 4.5% in September, and according to initial estimates, it fell to 3.7% in October. Core inflation also significantly decreased. Various indicators suggest a further relaxation in price dynamics.

Property yield, inflation, swap rate, government bond

Meanwhile, employment growth in recent months has come to a standstill. Depleting order books and a reduced number of new orders in several sectors have led to reduced demand for labor, even in the previously strong service sector.

Office take-up versus ifo Employment Barometer

After a year of overall economic weakness in 2023, Germany is expected to begin its recovery in 2024. However, the development in the real estate market will initially occur at different speeds and, in some cases, even in opposite directions. While some real estate investments and development projects from previous years will lead to further (distressed) sales and insolvencies due to expiring financing, investors can take advantage of targeted opportunities in the increasingly differentiated real estate market.

From a macroeconomic perspective, the last quarter of the year is expected to be characterised by weak dynamics. With decreasing inflation rates, increasing purchasing power, higher investment expenditures, and growing exports, a slightly positive economic growth is expected in 2024 before a more significant increase in Gross Domestic Product is anticipated in the following year, surpassing the growth of countries like the USA, UK, France, and the Eurozone as a whole.

From a macroeconomic perspective, the last quarter of the year is expected to be characterised by weak dynamics. With decreasing inflation rates, increasing purchasing power, higher investment expenditures, and growing exports, a slightly positive economic growth is expected in 2024 before a more significant increase in Gross Domestic Product is anticipated in the following year, surpassing the growth of countries like the USA, UK, France, and the Eurozone as a whole.

Investment market

After a year of overall economic weakness in 2023, Germany is expected to begin its recovery in 2024. However, the development in the real estate market will initially occur at different speeds and, in some cases, even in opposite directions. While some real estate investments and development projects from previous years will lead to further (distressed) sales and insolvencies due to expiring financing, investors can take advantage of targeted opportunities in the increasingly differentiated real estate market.

From a macroeconomic perspective, the last quarter of the year is expected to be characterised by weak dynamics. With decreasing inflation rates, increasing purchasing power, higher investment expenditures, and growing exports, a slightly positive economic growth is expected in 2024 before a more significant increase in Gross Domestic Product is anticipated in the following year, surpassing the growth of countries like the USA, UK, France, and the Eurozone as a whole.

From a macroeconomic perspective, the last quarter of the year is expected to be characterised by weak dynamics. With decreasing inflation rates, increasing purchasing power, higher investment expenditures, and growing exports, a slightly positive economic growth is expected in 2024 before a more significant increase in Gross Domestic Product is anticipated in the following year, surpassing the growth of countries like the USA, UK, France, and the Eurozone as a whole.

Commercial real estate investment volume

Since real estate values and prices in Germany are declining relatively slowly compared to other countries, and the entry level is currently perceived as too high by buyers, only a few transactions have been completed so far. Even though the third quarter was the strongest in the current year, the total investment volume in the first nine months amounted to only 15.1 billion euros, representing a 64% decrease compared to the previous year's result which in turn was virtually in line with the five-year average. The heavily affected office segment contributed only 3.5 billion euros, accounting for 24% of the total volume. In the average of the last five years, it was 18.7 billion euros with a 45% share. Office prime yields increased by 31 basis points on average during the third quarter, reaching 4.22%. By the end of the fourth quarter, prime yields are expected to rise to around 4.60%. Over the course of 2024, price adjustments in most market segments are expected to be completed. There may soon be more sales, especially when property owners need to free up capital in the course of refinancing or share returns. If these deals are made under sales pressure, they will be priced accordingly, but still can serve as points of orientation.

Prime yield

Germany: office markets

While the stable unemployment rate and the rising number of employed individuals, reaching record levels, provide a fundamental support to the office market, many office users are still in the process of determining their future work(place) concepts and space requirements. Some are hesitant to make long-term leasing decisions for new office locations and instead aim to negotiate short-term lease extensions with their landlords. The reluctance in occupier markets is still noticeable, especially in the case of large deals. In some markets, the mid-size segment, too, has thinned out, while small rentals continue to show strong activity.

However, the economic weakness does not translate to the office market one-to-one. In some markets, the third quarter was the strongest, while in others, it was the weakest of the year. Overall, the leasing activity in Berlin, Hamburg, Düsseldorf, and Frankfurt totalled 1.2 million square meters, which is 26% below the previous year and 22% below the five-year average.

However, the economic weakness does not translate to the office market one-to-one. In some markets, the third quarter was the strongest, while in others, it was the weakest of the year. Overall, the leasing activity in Berlin, Hamburg, Düsseldorf, and Frankfurt totalled 1.2 million square meters, which is 26% below the previous year and 22% below the five-year average.

Take-up: Berlin, Dusseldorf, Frankfurt, Hamburg

While vacancies increased in all cities considered, prime and submarket rents remained nearly unchanged in most areas. Only in Düsseldorf, there was a slight increase in prime rents during the third quarter. In several markets, particularly outside central locations, there is an increase in incentives offered by landlords.

Office prime rents and vacancy rates

Leading indicators like the ifo Employment Barometer reflect the declining willingness of companies to hire. In combination with the reduction in the utilization of office space, this indicates a dampened demand in the rental market in the short term. The better economic forecasts for 2024 and especially 2025 suggest improved prospects for the office space market since it closely correlates with Gross Domestic Product.

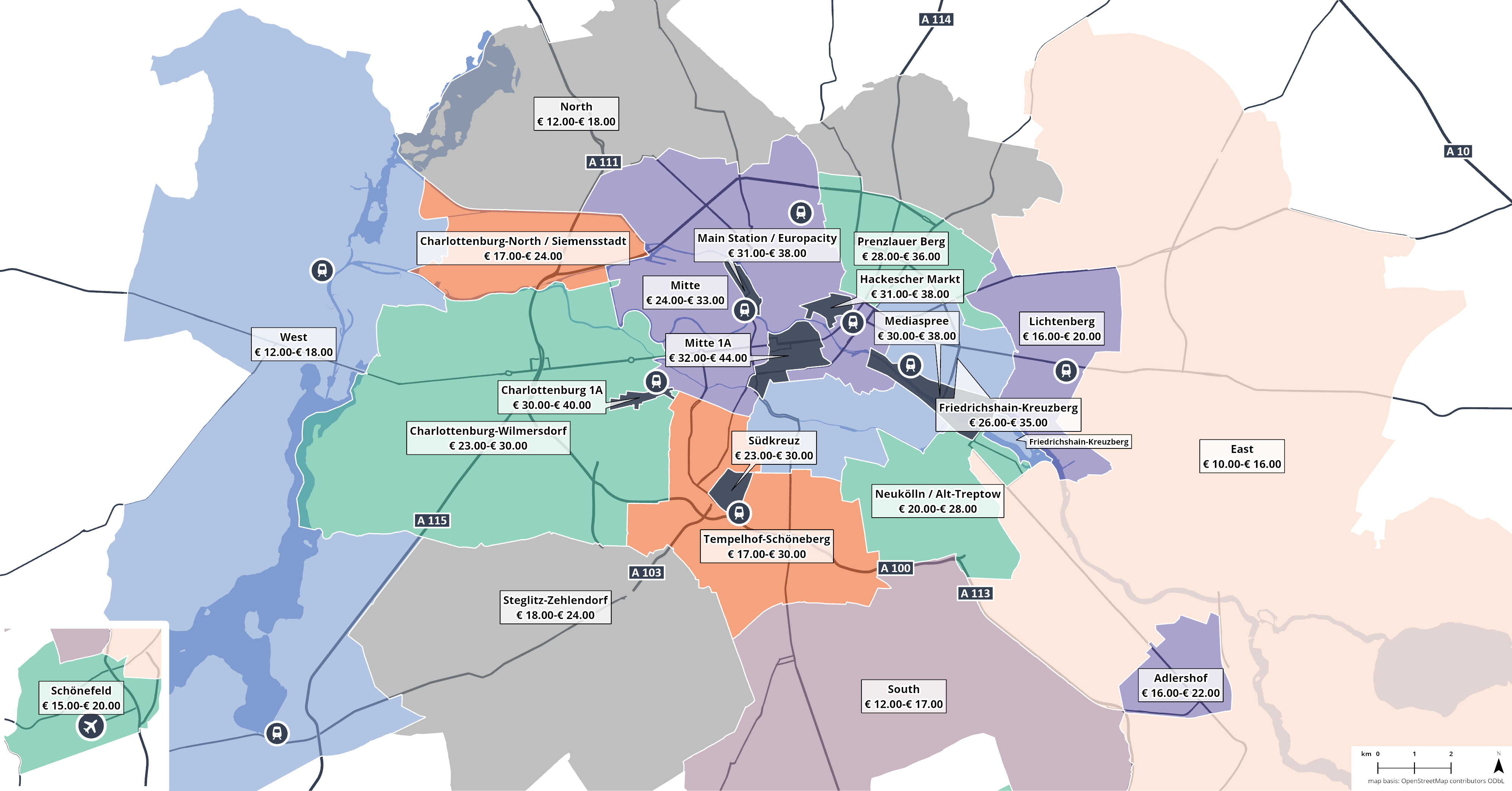

Berlin office market

The 33% increase in office space leasing in the third quarter (177,400 square meters) in comparison to the previous quarter cannot hide the fact that the leasing volume from January to September (450,900 square meters) represents a 24% decrease compared to the five-year average. By the end of the year, at least 600,000 square meters are expected to be available. The public sector was repeatedly involved in some of the largest deals.

Although vacancies have also increased, a rate of 4.7% is still too low to offer companies and institutions a sufficient selection of suitable spaces. Consequently, many users are turning to project leasing, especially since these spaces generally offer higher quality than existing properties. Meanwhile, the trend of offering sublease spaces as part of the vacancy continues. Additionally, through relocations and location consolidations, empty spaces are increasingly coming onto the market, especially from leases signed in the years before the pandemic when there was more emphasis on growth – nowadays, remote work is much more common. However, the demand for subleased spaces is also remarkable, and some spaces are being subleased at rates as high as 40.00 €/sq m/month, although most of these spaces are being let below 35.00 €/sq m/month.

The prime rent has remained unchanged. In the fourth quarter, it could reach 45.00 €/sq m/month for the first time as high-quality space continues to be sought after. Concurrently, in the next few quarters, large volumes of free space from the construction pipeline will be completed, which will put pressure on rents in some submarkets. Accordingly, many owners are currently very engaged in finding users for their spaces, particularly for newly built properties with a high proportion of debt capital and a too low (pre-) leasing rate, but also for some existing buildings.

Although vacancies have also increased, a rate of 4.7% is still too low to offer companies and institutions a sufficient selection of suitable spaces. Consequently, many users are turning to project leasing, especially since these spaces generally offer higher quality than existing properties. Meanwhile, the trend of offering sublease spaces as part of the vacancy continues. Additionally, through relocations and location consolidations, empty spaces are increasingly coming onto the market, especially from leases signed in the years before the pandemic when there was more emphasis on growth – nowadays, remote work is much more common. However, the demand for subleased spaces is also remarkable, and some spaces are being subleased at rates as high as 40.00 €/sq m/month, although most of these spaces are being let below 35.00 €/sq m/month.

The prime rent has remained unchanged. In the fourth quarter, it could reach 45.00 €/sq m/month for the first time as high-quality space continues to be sought after. Concurrently, in the next few quarters, large volumes of free space from the construction pipeline will be completed, which will put pressure on rents in some submarkets. Accordingly, many owners are currently very engaged in finding users for their spaces, particularly for newly built properties with a high proportion of debt capital and a too low (pre-) leasing rate, but also for some existing buildings.

Take-up, vacancy and prime rent

Take-up by Top 5 Sector

Take-up by size category

Top 5 Deals

| Tenant | Property | Submarket | Size |

| BImA - BKA | Neukölln / Alt-Treptow | 25,000 m² | |

| Boston Consulting Group (BCG) | AP 15 | Mediaspree | 19,200 m² |

| Jobcenter Marzahn-Hellersdorf | East | 12,800 m² | |

| Berlinovo Immobilien GmbH | Mitte 1A | 9,900 m² | |

| BIMA - LAF | North | 7,200 m² |

Completions

Rental bands - Berlin q3 2023

Source: Avison Young

Status: October 2023

Dusseldorf office market

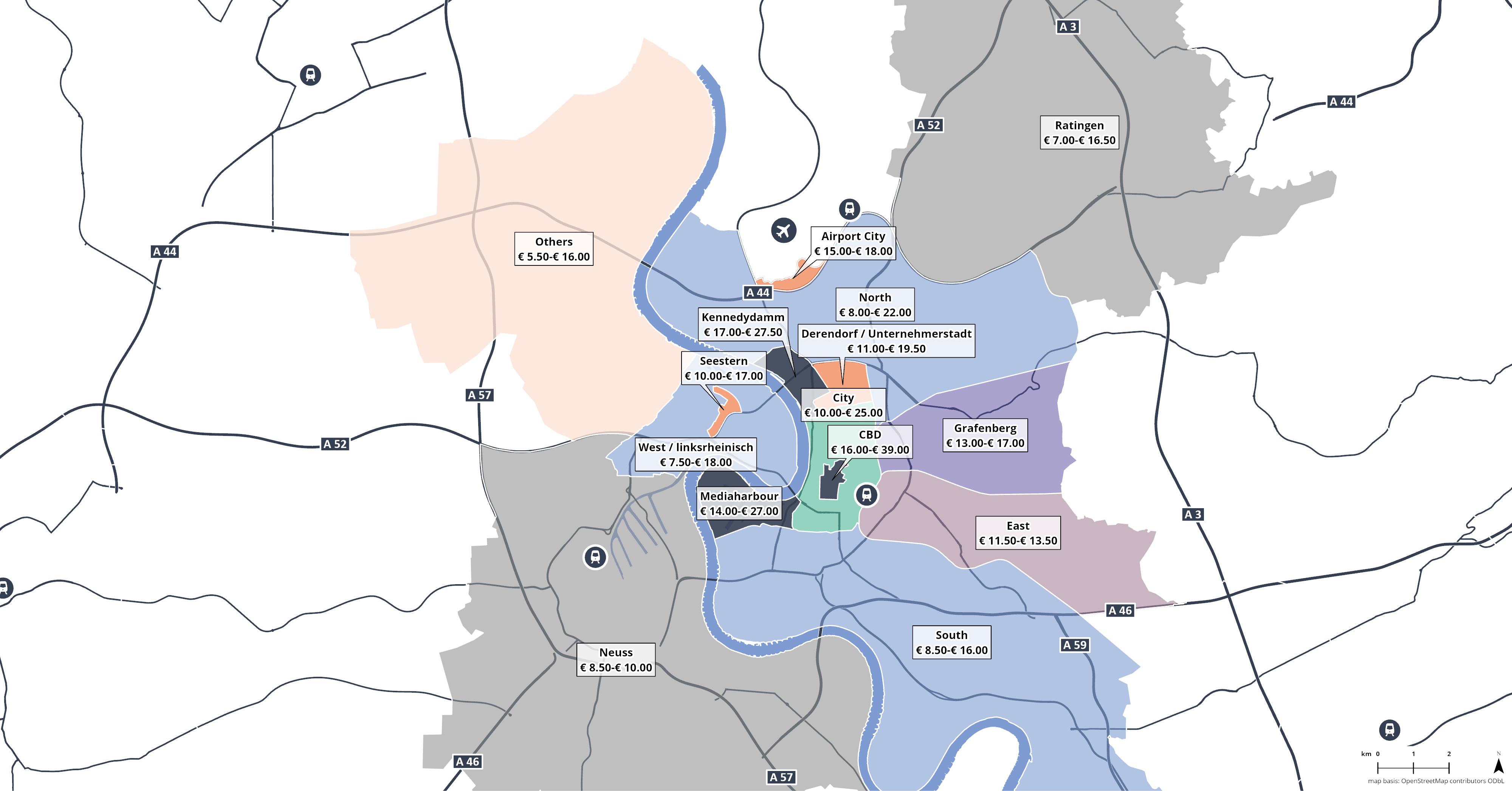

Although the third quarter, with nearly 85,000 square meters, was the strongest of the current year, the office space take-up for the first three quarters is 16% below the same period last year and 30% below the five-year average. The currently low overall take-up was due on the one hand to a lower number of large transactions from 5,000 square meters compared to the previous year. The largest transaction in the current year so far amounted to 27,100 square meters (Deutsche Rückversicherung/ ÖRAG Rechtsschutzversicherung in the West/linksrheinisch submarket). This however is significantly larger compared to the largest deal in the previous year (17,000 square meters, Landeshauptstadt Düsseldorf / VHS in the Derendorf submarket). On the other hand, the market's breadth is showing weak dynamics: more and more companies are actively reducing their floor space - meaning they don't wait for their lease to expire, but instead sublet excess space to the market - while holding back on new leases. Sublettings are not only happening from existing contracts: even with some prominent new leases, only a portion of the space is being fitted-out and occupied, and a subtenant is sought for the rest.

Due to this development, the vacancy rate is approaching double digits. Not only because of the increasing vacancies, but also the lack of ESG compliance in line with user requirements necessitates the repositioning of many properties. In particular, it will be challenging to retain users for properties in non-integrated locations.

Many planned construction projects have been cancelled. Nevertheless, large floor space volumes are expected from the construction pipeline: by the end of 2024, it is projected that approximately 185,000 square meters of available space, which are already under construction, will come onto the market, with many of them in central locations.

Due to this development, the vacancy rate is approaching double digits. Not only because of the increasing vacancies, but also the lack of ESG compliance in line with user requirements necessitates the repositioning of many properties. In particular, it will be challenging to retain users for properties in non-integrated locations.

Many planned construction projects have been cancelled. Nevertheless, large floor space volumes are expected from the construction pipeline: by the end of 2024, it is projected that approximately 185,000 square meters of available space, which are already under construction, will come onto the market, with many of them in central locations.

Take-up, vacancy and prime rent

Take-up by Top 5 Sector

Take-up by size category

Top 5 Deals

| Tenant | Property | Submarket | Size |

| Deutsche Rück / ÖRAG | Twin Cubes | West / Iinksrheinisch | 27,100 m² |

| Hengeler Mueller | Trinkhaus Karree | CBD | 9,600 m² |

| Niterra EMEA GmbH | The Square | Ratingen | 5,600 m² |

| Ed. Züblin AG | F101 | Airport City | 4,200 m² |

| Munichfashion.company | Kennedypark | Kennedydamm | 4,200 m² |

Completions

Rental bands - Dusseldorf q3 2023

Source: Avison Young

Status: October 2023

Frankfurt office market

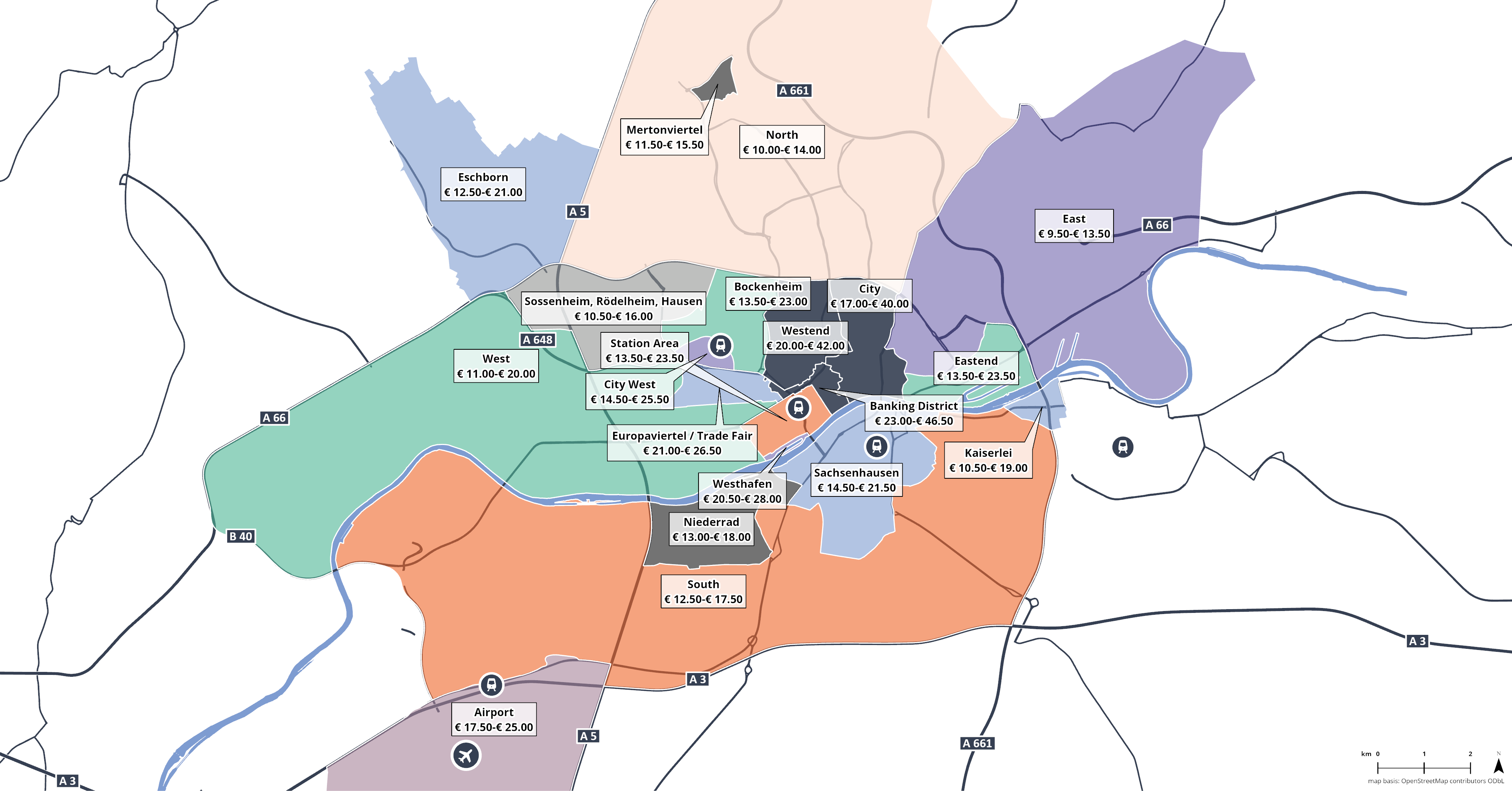

Despite some negative expectations, the Frankfurt office market held up well. The dynamics are solid, and the current turnover volume is only "merely" 12% below the five-year average, even though there was only one deal over 10,000 square meters. After the second quarter with a turnover of approximately 99,000 square meters was the strongest in the current year, the third quarter with approximately 92,000 square meters followed in second place.

The demand for central locations and top-quality products remains consistently high. Even though many expiring leases are from times of significantly lower rental price levels, companies are increasingly accepting rents starting from 35.00 €/sq m/month. This segment is currently a landlord's market. Owners of highly sought-after properties are not only raising the rent but also increasing the minimum lease terms – this applies not only to development projects but also to high-quality existing buildings. Incentives are hardly granted for top-quality products in central locations. In peripheral locations, it's a different story: generous incentives are sometimes granted, even for small leases.

Meanwhile, some space users are halving their space while more than doubling their rent in new leases. The growing adoption of hybrid work concepts (working in the office and from home) does not necessarily lead to a reduction in office space for all companies. Many firms continue to experience employee growth and are expanding their space needs, even in central and expensive office locations. At the same time, other companies continue to reduce their existing spaces, either through returning units when extending contracts or by freeing up space for subleasing.

The shortage of top-quality spaces, which is expected to persist in the future, is likely to lead to an increase in prime rent by the end of the year.

The demand for central locations and top-quality products remains consistently high. Even though many expiring leases are from times of significantly lower rental price levels, companies are increasingly accepting rents starting from 35.00 €/sq m/month. This segment is currently a landlord's market. Owners of highly sought-after properties are not only raising the rent but also increasing the minimum lease terms – this applies not only to development projects but also to high-quality existing buildings. Incentives are hardly granted for top-quality products in central locations. In peripheral locations, it's a different story: generous incentives are sometimes granted, even for small leases.

Meanwhile, some space users are halving their space while more than doubling their rent in new leases. The growing adoption of hybrid work concepts (working in the office and from home) does not necessarily lead to a reduction in office space for all companies. Many firms continue to experience employee growth and are expanding their space needs, even in central and expensive office locations. At the same time, other companies continue to reduce their existing spaces, either through returning units when extending contracts or by freeing up space for subleasing.

The shortage of top-quality spaces, which is expected to persist in the future, is likely to lead to an increase in prime rent by the end of the year.

Take-up, vacancy and prime rent

Top 5 Deals

| Tenant | Property | Submarket | Size |

| Keyence Deutschland GmbH | The Move Orange | Airport | 12,000 m² |

| Universal-Investment GmbH | Timber Pioneer | Europaviertel / Trade Fair | 9,600 m² |

| Staatliches Schulamt Frankfurt | Sossenheim, Rödelheim, Hausen | 9,100 m² | |

| Eintracht Frankfurt | South | 8,800 m² | |

| Massif Central | Bethmannhof | City | 8,000 m² |

Completions

Rental bands - Frankfurt q3 2023

Quelle: Avison Young

Stand: October 2023

Hamburg office market

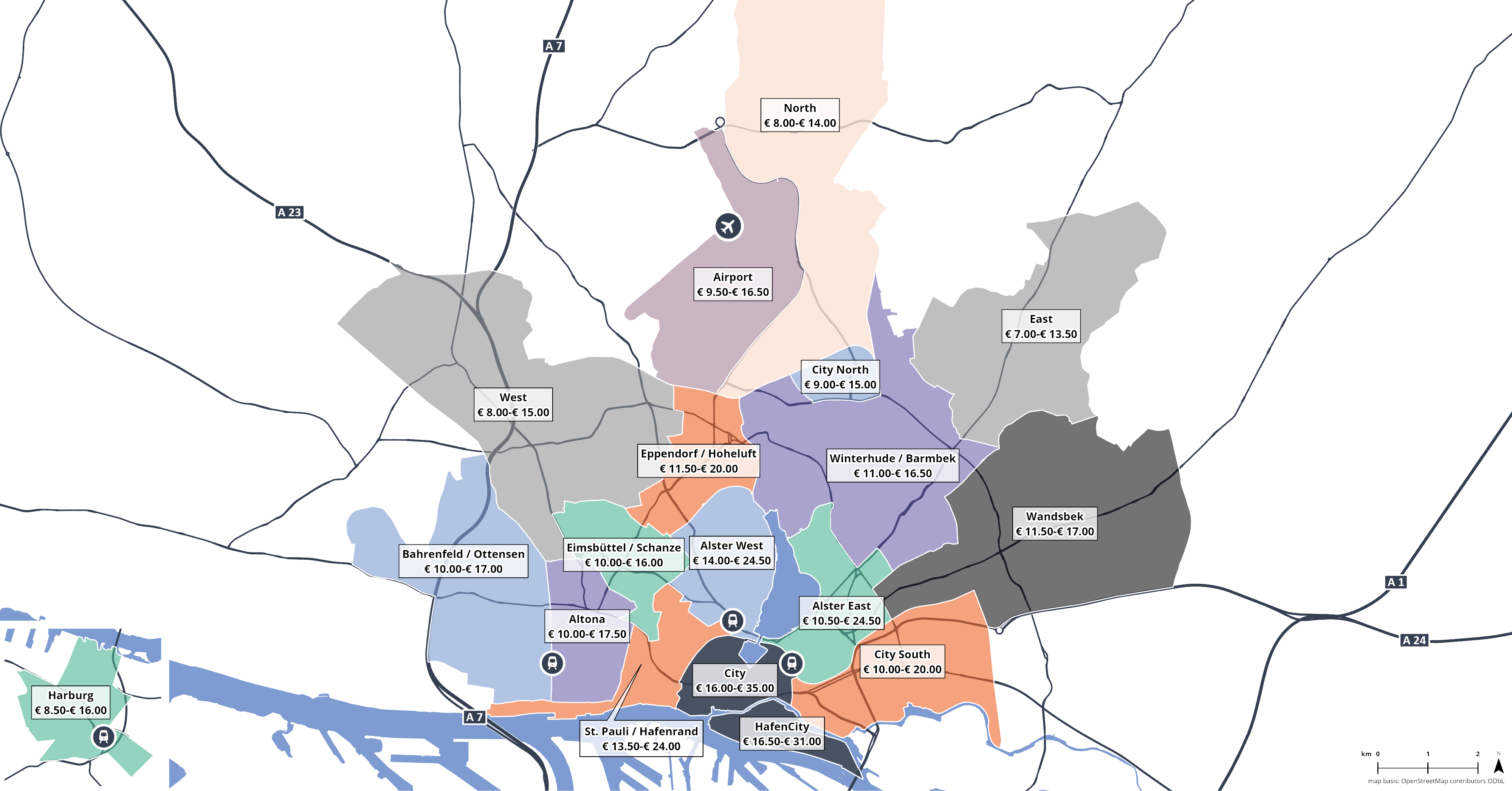

The turnover of 319,000 square meters is 15% below the five-year average and illustrates a generally mixed first three quarters. Nevertheless, two deals over 10,000 square meters were concluded, accounting for a combined 29,200 square meters or 9% of the total turnover. The highest activity was observed in the smaller segments: transactions under 1,000 square meters accounted for about one-third of the demand volume. Interest in inner-city locations remains high, even and especially from users in district or decentralised locations, but the lack of availability is partially inhibiting take-up activity. Lease extensions due to a lack of available space are partially the result. The vacancy has only slightly increased in the third quarter. The current vacancy rate of 3.9% is the lowest of all the German office markets considered here. Especially in highly sought-after inner-city locations, there is a shortage of high-quality spaces. Additionally, project developments will barely bring corresponding – and still available – spaces to the market in the next few quarters. This could lead to further market differentiation next year: while the potential for rising rents is building for high-quality spaces in central locations, many owners in peripheral locations have already increased their incentive packages and reduced effective rents. However, even nominal rents can come under pressure for less sought-after spaces. In the third quarter, both, rental bands in the submarkets and the prime rent remained stable, and a sideways movement is expected for the last quarter of the year initially.

Take-up, vacancy and prime rent

Take-up by Top 5 Sector

Take-up by size category

Top 5 Deals

| Tenant | Property | Submarket | Size |

| Gruner + Jahr AG & Co. | HafenCity | 17,200 m² | |

| Airbus | North | 12,000 m² | |

| Bürgerschaft Hamburg | City | 9,850 m² | |

| Deutsche GigaNetz | TRIIIO Hamburg | City | 7,250 m² |

| Telefónica Germany GmbH | Tichelhaus | City | 7,000 m² |

Completions

Rental bands - Hamburg q3 2023

Source: Avison Young

Status: October 2023

Kontakte

- Director Market Intelligence, Germany

- Market Intelligence